Understanding Credit Card Statements Exercise

Area of Study: CEE – Using Credit. Grade 8 Benchmark 3

When you make a credit card purchase, you’re using the credit card company or financial institution‘s money instead of your own. This is a form of loan, often with high interest.

A financial institution can be a bank or credit union. When they offer a loan, they will specify a repayment period and an interest rate for the loan.

For credit cards, there is a monthly repayment as long as you’re using the card. Financial institutions may also charge high fees on credit cards.

Though it may feel like free money at the time, you still have to pay back what you owe on time and in full, or you will be charged interest and/or late fees.

Some cards charge interest from the moment of purchase, even if you pay in full and on time. Be aware of this when opening your first credit line, as they are often offered to those with no credit history!

What is Interest?

Interest is a charge to compensate for the use of the money you borrow. It is one way that financial institutions make money from you.

You can choose to pay your balance in full each month, but need to make at least the minimum payment indicated on your statement. Financial institutions charge interest on any portion of your balance not paid by the due date.

Annual Percentage Rate Definition: Annual Percentage Rate, or APR, is the annual interest rate charged on your account.

But interest is not the only way you may be charged. If you don’t pay at least the minimum payment due on time, you incur a late fee.

Click here to download the exercise:

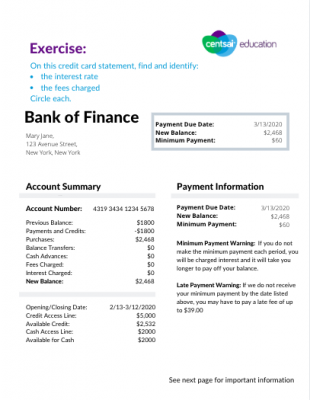

On this credit card statement, find and identify:

- the interest rate

- the fees charged

- Circle each.